Getting a NOW Personal Loan rate estimate

This article outlines how to get your client's rate estimate for a NOW Personal Loan

Rate Estimate Eligibility Considerations

Your client may not qualify for a rate estimate due to some of these factors:

- If your client's comprehensive credit score is below 420

- If your client's Equifax One score is below 400

- If your client has a financial default, more than one utility default, a judgement or bankruptcy on their credit file

- If the RHI data has a 6 or X or recent missed payments

How to get an unsecured loan rate estimate

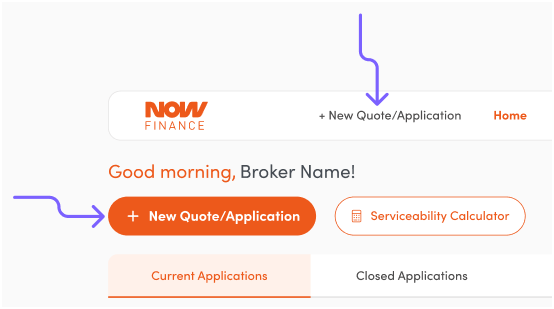

1. In the Application Portal home screen, click New Quote/Application.

2. Select the Loan Type (Personal Loan), then choose the Loan Purpose. Complete the requested fields and click Next.

3. On the Applicant Details tab, enter the applicant’s information, including their contact details, residential status, and employment status, then click Next to continue.

4. The NOW Personal Loan quote will be displayed.

If required, discount the interest rate and then click Calculate to check the impact to your client's repayments and your commission (excluding GST).

Click Start Application to move to the next step.

You can also click Save Quote if you wish to return to it later.

If your client receives the default rate of 22.75%, that means there was no credit file found.

Check for entry errors on the quote, then complete a new quote with the correct customer details to get the correct interest rate.

| ➡️ Next Step: Submitting a loan application |